LIC Agent Commission Complete Details

Becoming an LIC (Life Insurance Corporation of India) agent is not only a respected profession but also one of the most rewarding careers in the insurance sector. One of the biggest attractions for joining LIC as an agent is the high earning potential through commissions. In this article, we’ll cover all aspects of LIC agent commission, including types, structure, payment cycle, and long-term income benefits.

What is LIC Agent Commission?

The LIC agent commission is the income earned by agents for selling LIC insurance policies. It is a percentage of the premium amount paid by the customer. Agents earn commission on every policy they sell and continue to receive renewal commission for the duration of the policy term.

Types of Commissions for LIC Agents

First-Year Commission (FYC)

This is the commission earned when a policy is sold.

The percentage varies based on the type of policy and premium mode.

Renewal Commission

After the first year, LIC agents continue to earn a commission on premiums paid in subsequent years.

This can go up to 5% depending on the policy.

Bonus Commission / Additional Incentives

LIC offers performance-based bonuses and incentives.

These include cash rewards, foreign trips, gold medals, and more.

LIC Agent Commission Structure (2025)

Here’s a basic overview of the commission structure:

| Policy Type | 1st Year Commission | 2nd & 3rd Year | 4th Year Onwards |

|---|---|---|---|

| Endowment Plans | 25% to 35% | 7.5% | 5% |

| Term Insurance | 5% to 10% | 2% to 3% | 2% to 3% |

| Whole Life Policies | 30% | 7.5% | 5% |

| Money Back Policies | 15% to 25% | 5% | 5% |

| ULIP Policies | 2% to 5% | Nil or minimal | Nil or minimal |

Note: The commission percentage depends on the type of plan, premium term, and sum assured.

Sample Income Example

If you sell an Endowment policy with an annual premium of ₹50,000:

First-Year Commission (25%) = ₹12,500

2nd Year (7.5%) = ₹3,750

From 4th Year (5%) = ₹2,500 yearly till policy term ends

Now imagine selling 10 such policies per year — your recurring income can grow significantly.

Lifetime Earning Potential

One of the biggest advantages of being an LIC agent is the lifetime renewal commission. Once you have a solid client base, even if you stop actively selling, the policies you’ve already sold will continue to generate income year after year.

This is often called “Pension by Commission”.

How to Maximize Your Commission

Focus on long-term premium plans (like endowment and whole life policies)

Build a large customer base for steady renewal income

Upskill and get MDRT/COT qualifications for extra incentives

Provide excellent customer service to retain clients

Commission Payment Cycle

LIC agents receive commission monthly.

Payments are credited directly to the agent’s bank account.

A detailed commission statement is provided.

Tax on LIC Agent Commission

LIC agent commission is considered professional income. If your annual commission income exceeds ₹60,000, LIC will deduct TDS (Tax Deducted at Source) at applicable rates.

Final Thoughts

Becoming an LIC agent is not just about selling policies — it’s about building long-term wealth. The LIC commission model is passive and recurring, making it one of the most lucrative career options for those who want financial independence, flexible working hours, and unlimited income potential.

FAQs – LIC Agent Commission

Q1. How much commission does an LIC agent get on term insurance?

Ans: Around 5–10% for the first year, and 2–3% renewal for a few years depending on policy.

Q2. Is LIC agent income fixed or variable?

Ans: It is variable and purely based on your sales performance.

Q3. How long does an agent earn commission on a single policy?

Ans: Up to the entire duration of the policy (up to 20–30 years).

Q4. Can LIC agents earn commission after retirement?

Ans: Yes, agents receive renewal commission even after stopping active work, if they fulfill retention criteria.

Q5. Is there any limit on how much an LIC agent can earn?

Ans: No, there is no income cap – more policies sold = more commission.

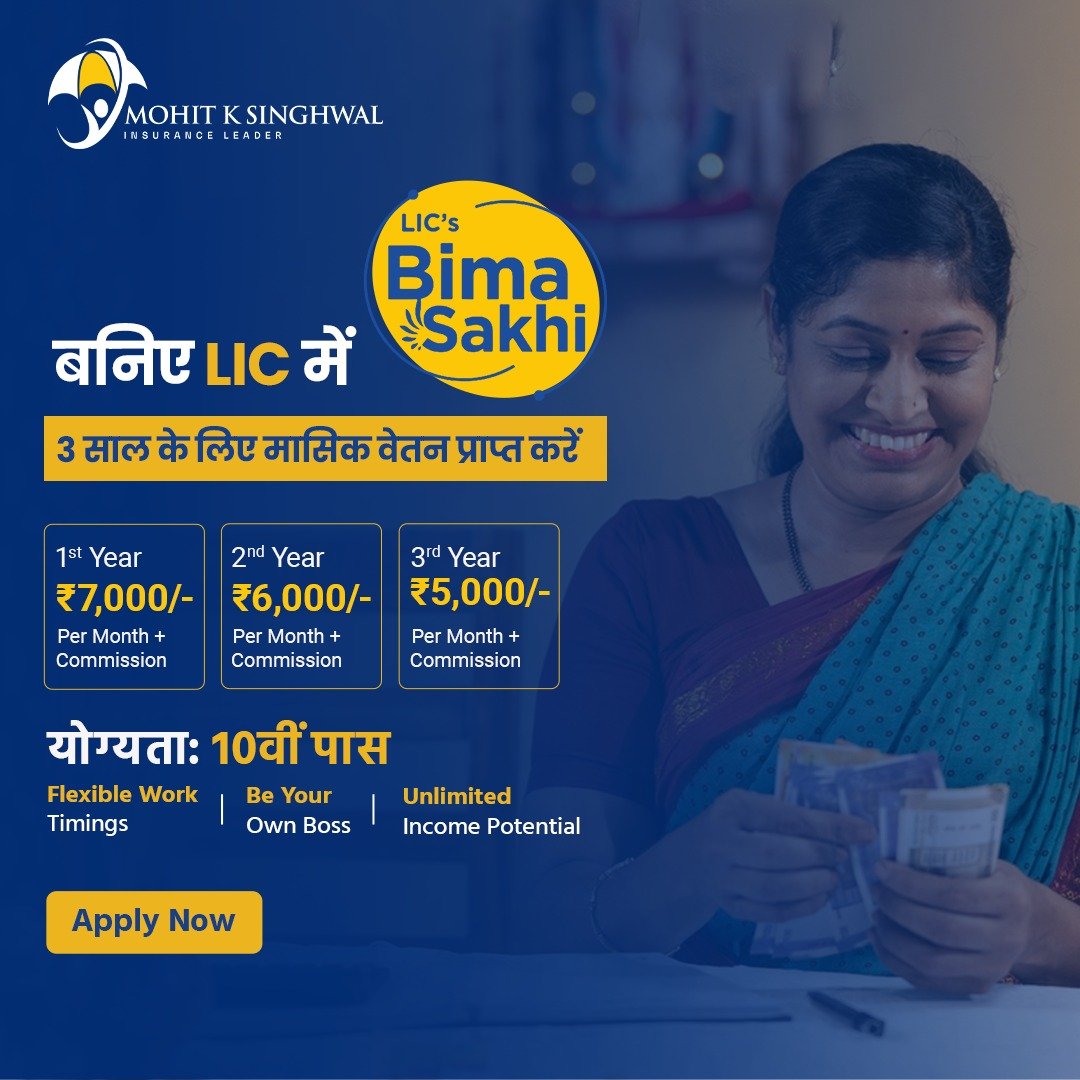

Who can become a LIC Agent in Delhi?

How can I apply to become a LIC Agent?

What is the age and qualification required?