LIC’s Bima Shree Plan

It is a non linked, with profits, limited premium payment money back life insurance plan with minimum Basic Sum Assured of Rs. 10 Lakh especially designed for targeted High Net-worth Individuals. This plan provides lump sum financial support to family in case of death but also provides payment in case of diagnosis of specified critical illness.

Combination of Moneyback and Life Insurance

It gives you a lump sum amount in case of death during policy term and incase of survival, survival benefit amount is payable on Term – 4 Years, Term – 2 Years and on completion of Term.

Premium Waiver Benefit

In case of death of Proposer wherein life assured is minor, all future premiums will be borne by LIC.

Profit Sharing in Terms of Guaranteed Additions

Policy is eligible for guaranteed bonus at the rate of Rs. 50.00 per thousand per year during the first 5 policy terms and thereafter at the rate of Rs. 55.00 per thousand per year.

Additional Accidental Benefit

Standalone Additional Accident Benefit Maximum of Rs. 1,00,00,00/- is allowed other than regular accidental benefit under other policies.

Advantages

Avail Tax benefit on premium paid

Tension Free Claim Settlement

Eligibility Criteria:

| Minimum | Maximum |

Entry Age | 8 Years (completed) | 55 Years (nearer birthday) for Policy Term 14 Years |

Term | 14, 16, 18, 20, 24 and 28 Years | |

PPT | (Policy Term – 4) Years | |

Sum Assured | ₹ 10,00,000/- | No Limit |

Premium Modes

Yearly, Half-Yearly, Quarterly and Monthly (NACH only) or through salary deductions (SSS).

Riders Available

LIC’s Accidental Death and Disability Rider

LIC’s Accident Benefit Rider

LIC’s New Term Insurance Rider

LIC’s Premium Waiver Benefit Rider

Death Benefit

On death of the Life Assured during First Five Policy Years: Dearth Benefit defined as sum of “Sum Assured on Death” and accrued Guaranteed Addition shall be payable.

On death after completion of Five Policy Years but before the date of Maturity: Dearth Benefit defined as sum of “Sum Assured on Death” and accrued Guaranteed Addition and Loyalty Addition shall be payable.

Where “Sum Assured on Death” is defined as higher of 125% Basic Sum Assured or 7 times of annualised premium.

This Death Benefit (as defined above) shall not be less than 105% of total premiums paid up to the date of death. Where,

1. “Annualized Premium” shall be the premium amount payable in a year, excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums.

2. “Total Premiums Paid” means total of all the premiums paid under the base product, excluding any extra premium, and taxes, if collected explicitly. In case LIC’s Premium Waiver Benefit Rider is opted for, in the event of death of Proposer, any subsequent Premiums which are waived shall be deemed to have been received and be included in the Total Premiums Paid.

Survival Benefit

Policy Term | Survival Benefits Years |

14 Years | 30% of Basic Sum Assured on each of 10th and 12th Policy Anniversary |

16 Years | 35% of Basic Sum Assured on each of 12th and 14th Policy Anniversary |

18 Years | 40% of Basic Sum Assured on each of 14th and 16th Policy Anniversary |

20 Years | 45% of Basic Sum Assured on each of 16th and 18th Policy Anniversary |

24 Years | 45% of Basic Sum Assured on each of 20th and 22nd Policy Anniversary |

28 Years | 45% of Basic Sum Assured on each of 24th and 26th Policy Anniversary |

Maturity Benefit

40% of Basic Sum Assured on Maturity alongwith accrued Guaranteed Additions and Loyalty Addition.

Loan Facility is available after completion of the first policy year provided one full year’s premium has been paid.

Option to Surrender the Policy

The policy can be surrendered by the policyholder after completion of the first policy year provided at least one full year’s premium(s) has been paid. However, the policy shall acquire Guaranteed Surrender Value on payment of at least two full years’ premiums and Special Surrender Value after completion of first policy year provided one full year’s premium(s) has been paid. On surrender of an in-force or paid-up policy, the Corporation shall pay the surrender value equal to the Guaranteed Surrender Value and Special Surrender Value.

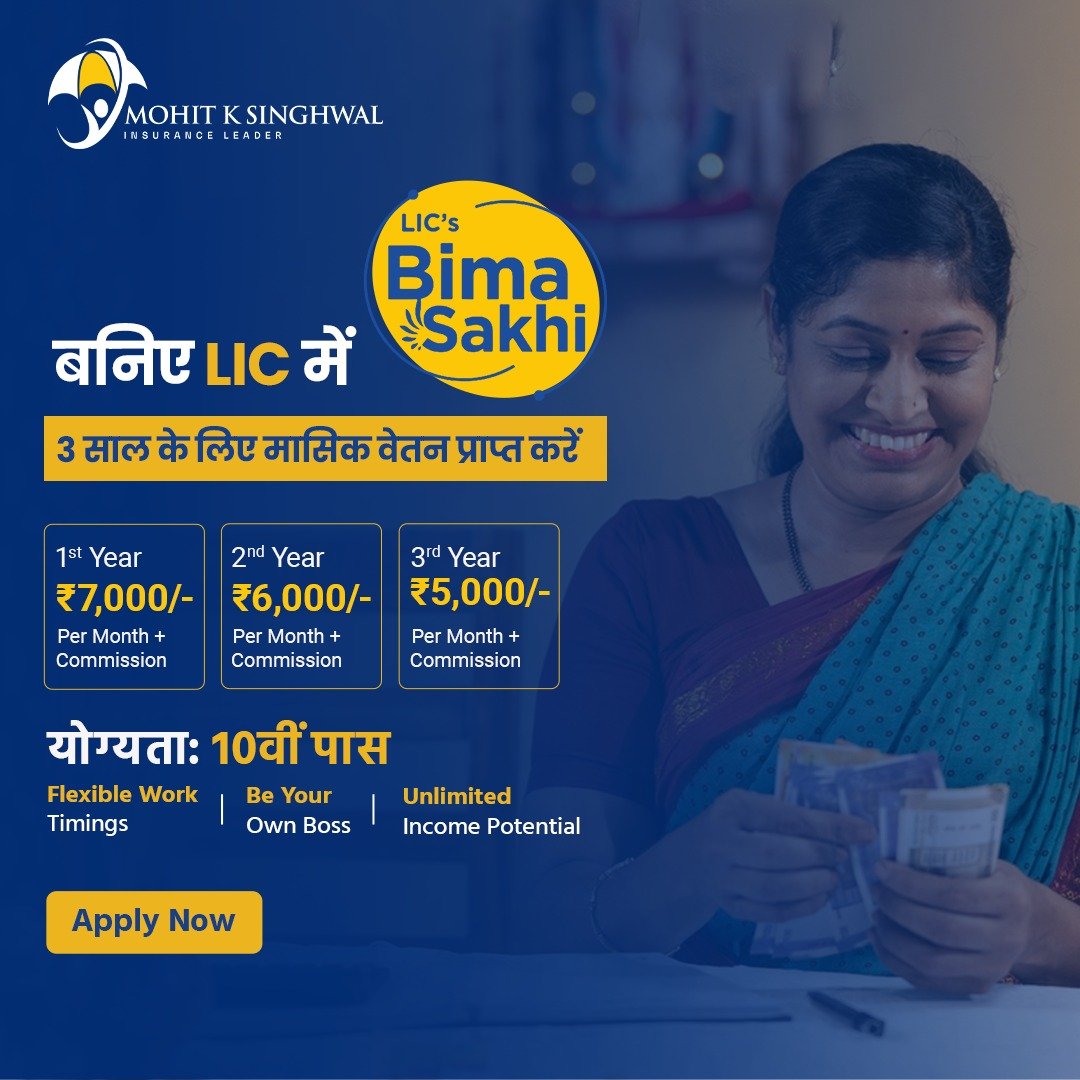

What is LIC Bima Sakhi Yojana?

Who can become a Bima Sakhi?

What kind of training will be given?