LIC Amritbaal Plan 774

LIC Amritbaal Plan 774 is a non-linked, non-participating individual savings and life insurance plan. LIC’s Amritbaal is an Endowment Plan that provides Guaranteed Additions to various needs of children like higher education and others.

Guaranteed Additions Every Year

Rs. 80 per Rs. 1000 of Basic Sum Assured for each completed year till the end of the policy term

Option to choose Life Insurance Coverage for your Child as per the needs

You can choose Sum Assured as per the need in future to fulfil your child’s dream

Flexibility to choose Maturity Age from 18 to 25 Years

Choose Maturity Age to cover various needs like Education, Marriage and other needs of your Child.

LIC Amritbaal Plan 774 Advantages

Premium Waiver Benefit Rider is Available

Loan facility is also Available

LIC Amritbaal Plan 774 Eligibility Criteria:

Minimum | Maximum | |

Age at Entry | 30 Days (completed) | 13 Years (completed) |

Term | 5 Years under Single Premium | 25 Years |

10 Years under Limited Premium | ||

Sum Assured | Rs. 2,00,000 | No Limit |

Premium Paying Term | 5, 6 and 7 Years for Limited Premium | |

Single Premium | ||

Premium Modes

Premium can be paid either under Limited Premium payment or Single Premium Payment options under this plan. In case of Limited Premium payment, premium can be paid regularly during the premium paying term with modes of premium payment Yearly, Half-Yearly, Quarterly or Monthly (through NACH only) or through salary deductions (SSS).

Riders Available

LIC’s Premium Waiver Benefit Rider

Premium Waiver Benefit Rider is available. It can be opted anytime during the minority of the child, provided the outstanding premium paying term is at least 5 years

Guaranteed Additions

Rs. 80 per Rs. 1000 of Basic Sum Assured for each completed year till the end of the policy term

Maturity Benefits

On the life assured surviving to the end of the policy term, provided all due premiums have been paid, “Sum Assured on Maturity” along with accrued Guaranteed Additions, shall be payable; where “Sum Assured on Maturity” is equal to Basic Sum Assured.

Death Benefits

Premium Payment | Option | Sum Assured on Death is Higher of |

Limited Premium Payment | Option I | 7 times of Annualised Premium |

Basic Sum Assured | ||

Option II | 10 times of Annualised Premium | |

Basic Sum Assured | ||

Single Premium Payment | Option III | 1.25 times of Single Premium |

Basic Sum Assured | ||

Option IV | 10 times of Single Premium |

- Annualized Premium shall be the premium amount payable in a year, excluding the taxes, rider premiums, underwriting extra premiums and loading for modal premiums.

- Single Premium shall be the premium amount chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums, if any.

Death Benefit payable, on death of the Life Assured, during the policy term after the date of commencement of risk but before the date of maturity, provided the policy is in-force, shall be “Sum Assured on Death” along with accrued Guaranteed Additions for in-force policy where “Sum Assured on Death” shall be as per the Option selected.

The death benefit under Limited Premium payment (Option I & Option II) shall not be less than 105% of ‘Total Premiums Paid’ up to the date of death. Where, Total Premiums Paid means the total of all premiums received under the base policy, excluding any extra premium, and taxes, if collected explicitly.

In case LIC’s Premium Waiver Benefit Rider is opted for, in the event of death of Proposer, any subsequent Premiums which are waived shall be deemed to have been received and be included in the Total Premiums Paid. However, in case of minor Life Assured, whose age at entry is below 8 years, on death before the commencement of risk, the death benefit payable shall be refund of premium(s) paid (excluding taxes, any extra premium, if collected explicitly, rider premium(s), if any), without interest.

Surrender

Under Limited Premium Payment (Option I & Option II), the policy can be surrendered by the policyholder after completion of the first policy year provided at least one full years’ premiums has been paid. Under Single Premium Payment (Option III & IV), the policy can be surrendered at any time during the policy term.

Under Limited Premium Payment (Option I & Option II) the policy shall acquire Guaranteed Surrender Value on payment of at least two full years’ premiums and Special Surrender Value after completion of first policy year provided one full year’s premium(s) has been paid.

Loan

Under Limited Premium payment (Option I & Option II), loan can be availed after completion of first policy year provided at least one full years’ premium has been paid.

Under Single Premium payment (Option III & Option IV), loan can be availed during the policy term at any time after three months from the completion of the policy (i.e. 3 months from the Date of issuance of policy) or after expiry of the Free-Look Period, whichever is later.

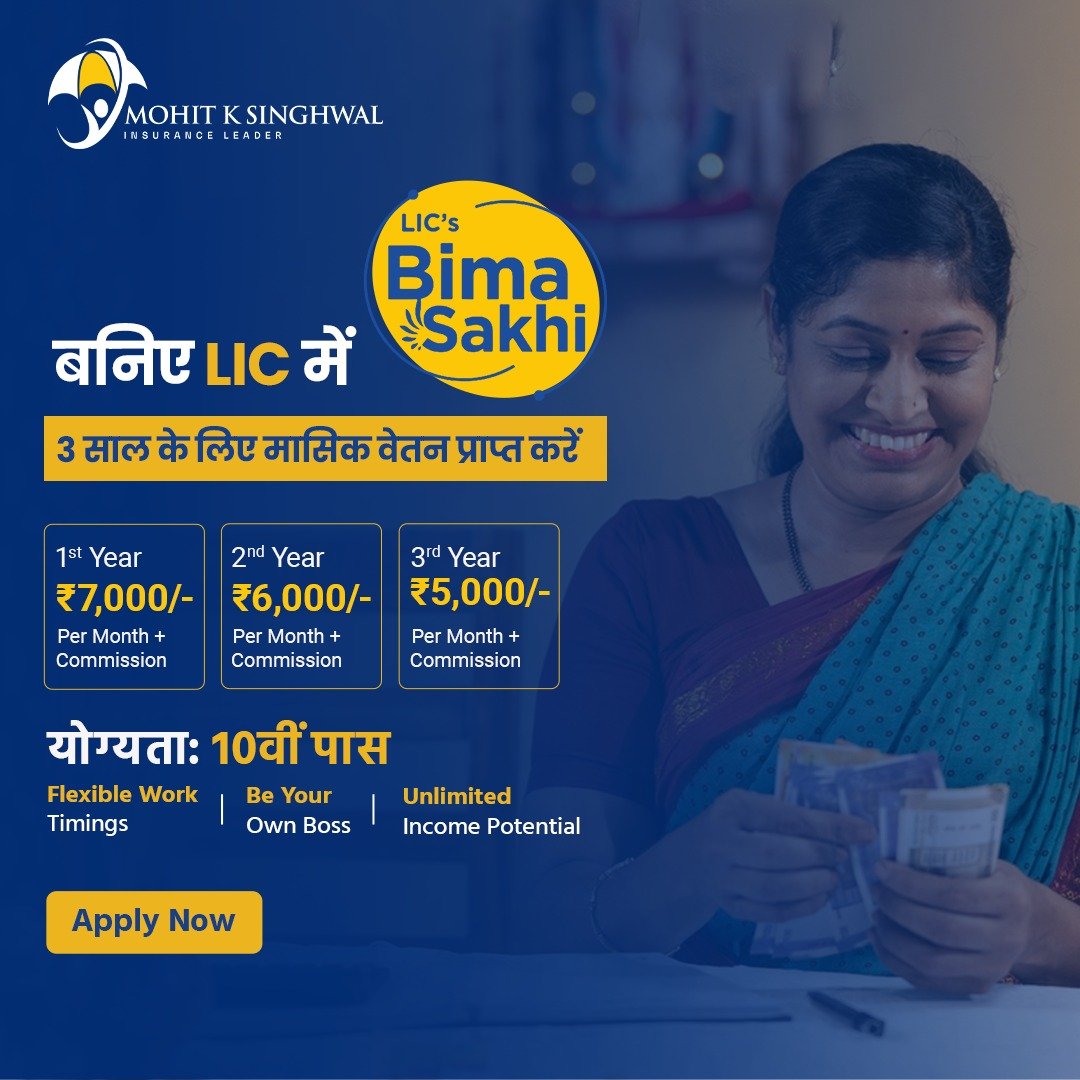

Join Bima Sakhi

What is LIC Bima Sakhi Yojana?

Who can become a Bima Sakhi?

What kind of training will be given?